Every competitive deal feels like a contact sport. Your reps are smart, they're hungry, and they're losing deals they shouldn't be losing — because they're walking in blind. RAINCLOUD puts current, proven intelligence in their hands before every conversation.

Arm Your Team →Your rep is on a call in 20 minutes. The prospect just mentioned they're also evaluating DataCore. The rep pings you on Slack. You type something from memory — half-right, maybe — and hope it lands. This happens three times a week. Every time, you're guessing. Every time, your rep knows you're guessing.

Marketing created them 14 months ago. They reference a competitor feature that was deprecated in Q2. The pricing section says "contact us" because nobody updated it when you went through your last pricing revision. Your best reps ignore them completely. Your newest reps use them and walk into conversations with wrong information. Both outcomes are bad.

CRM says "competitive loss." But was it pricing? Was it a feature gap? Did the competitor have a champion inside? Did the rep fail to handle a specific objection? You run the post-mortem and get the version of events the rep is comfortable sharing — not the version on the recording. The patterns that could save the next 10 deals are locked in call recordings nobody will ever review.

Your team won a tough deal against CloudShield last month. The rep used a brilliant reframe on the pricing objection. That knowledge lives in one person's head. The next rep who faces CloudShield will reinvent the wheel — or, more likely, lose. There's no system to capture what works and distribute it to the team. Tribal knowledge is your competitive strategy, and tribal knowledge doesn't scale.

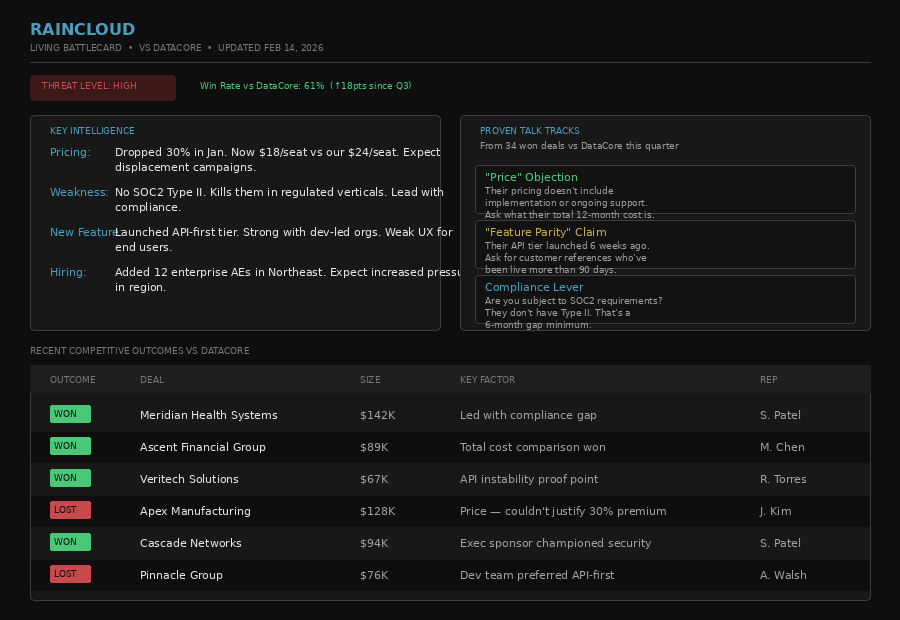

Not a PDF that marketing made once. A living document updated monthly from the analysis of every competitive call your team recorded. Current pricing. Proven talk tracks from deals you actually won. Objection handling that works because it was tested in real conversations last month.

This isn't a competitive overview. It's a weapon. Current intelligence, proven talk tracks, and a scorecard of recent outcomes — so your rep knows exactly what's working against this competitor right now, not six months ago.

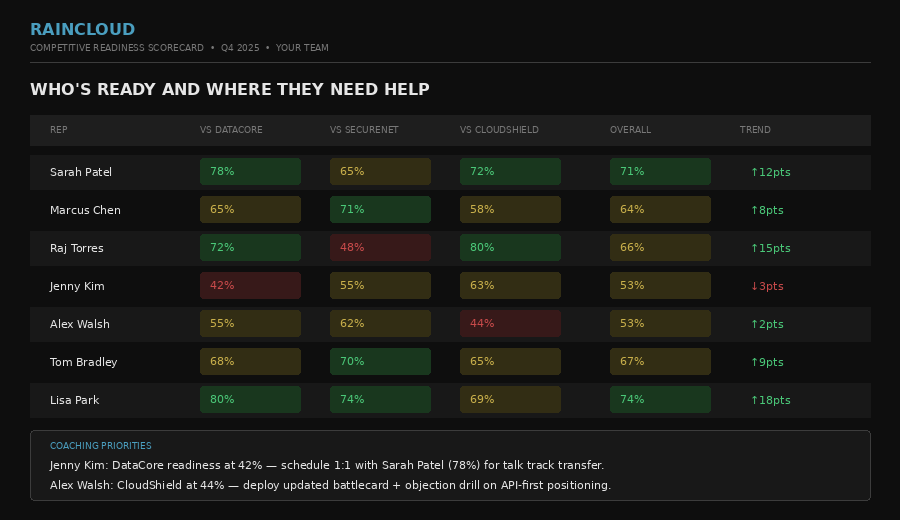

You manage 7 reps. Each one has different strengths against different competitors. Quarterly, we analyze competitive deal outcomes per rep to show you exactly who's ready for which fight — and where targeted coaching will have the highest impact on win rates.

"My reps stopped asking me what to say about the competition. Not because they stopped caring — because they already had the answer."

The same deal. The same objection. Two completely different outcomes depending on whether your team has current intelligence or not.

"DataCore just came up. They're saying they're 30% cheaper. What do I say?"

You're in a meeting. You respond 45 minutes later with something from memory. The rep uses it on the next call but the framing doesn't land because the data is wrong — DataCore's pricing changed two months ago and you didn't know.

The champion goes quiet. Two weeks later, the deal is marked "Closed Lost — Competitive." In the post-mortem, you learn the prospect had compliance requirements that DataCore can't meet. Nobody raised it because nobody knew to ask.

Result: $128K deal lost. Winnable.

Updated last week. Current pricing: $18/seat — the 30% drop happened in January. The proven response: reframe to total 12-month cost including implementation and support. DataCore doesn't include either.

The rep also sees the compliance lever: DataCore doesn't have SOC2 Type II. The prospect is in financial services. The rep asks: "Are you subject to SOC2 requirements?" The prospect's CISO joins the next call.

The rep didn't need to ask you anything. The intelligence was current, proven, and available before the conversation started.

Result: $128K deal won. Rep closed it faster than any previous DataCore competitive deal.

Reps use battlecards that reflect reality. When the intel is current and the talk tracks come from won deals, adoption isn't a problem.

Not from better reps. From the same reps with better intelligence. The team you have is capable of winning more — they just need the ammunition.

Day one, every new hire has current competitive intelligence, proven talk tracks, and a readiness scorecard showing exactly where to focus.

Reps who know what competitors actually charge don't panic-discount. Confidence comes from data, and data comes from RAINCLOUD.

Every Monday, a digest of competitive moves that matter. Your team starts the week knowing what changed — not finding out when they lose a deal.

Battlecards in their inbox. Radar in Slack. Nothing to log into, nothing to learn. Intelligence delivered where your reps already work.

The Intelligence Audit analyzes your last two quarters of competitive calls and surfaces the patterns your team is missing. In two weeks, your reps will have current battlecards, proven talk tracks, and a clear picture of what's actually happening in their deals. $7,500, credited against any retainer.

Book Your Intelligence Audit →