Your board doesn't want dashboards. They want to know why you're winning, why you're losing, and what you're going to do about it. RAINCLOUD gives you the competitive intelligence to answer those questions with data — not anecdotes.

See What's Hiding in Your Data →The board asks about your competitive position and you cobble together something from a handful of deal post-mortems and whatever your top rep told you last week. You know it's not rigorous. They know it's not rigorous. But nobody has anything better because the data is trapped in 500 call recordings nobody has time to listen to.

You see it in the CRM. Down 8 points this quarter. Sales says "competitive pressure" but can't tell you which competitor, which objections, or which deals were actually winnable. You're making resource allocation decisions — headcount, territory, pricing — based on a number you can't decompose. That's not leadership. That's guessing.

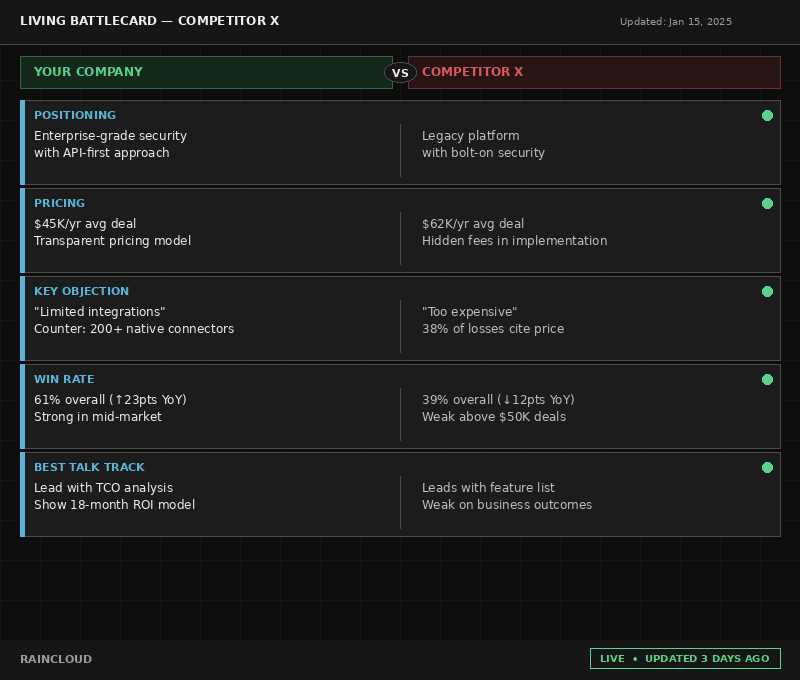

The PMM who built them left eight months ago. The pricing is wrong. The competitive positioning references a feature your competitor deprecated in Q2. Your reps know this, which is why they stopped using them. But they have nothing to replace them with, so they're winging it — using whatever they remember from the last deal they lost.

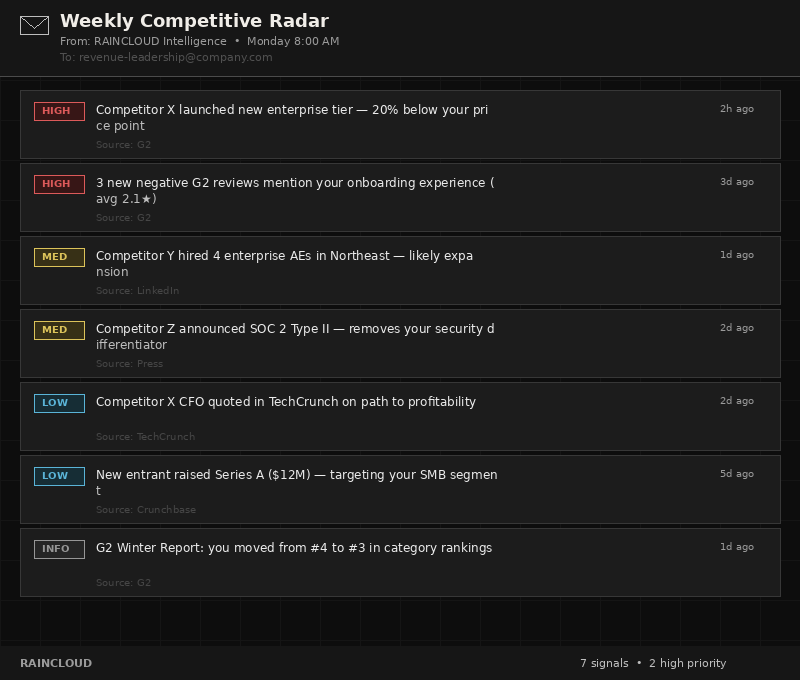

You find out about competitive moves when they show up in your pipeline. A competitor launches a new product tier and your first signal is three reps asking "what do we say about this?" in the same week. By then you've already lost the first wave of deals. The intelligence gap isn't a nice-to-have. It's costing you pipeline every quarter.

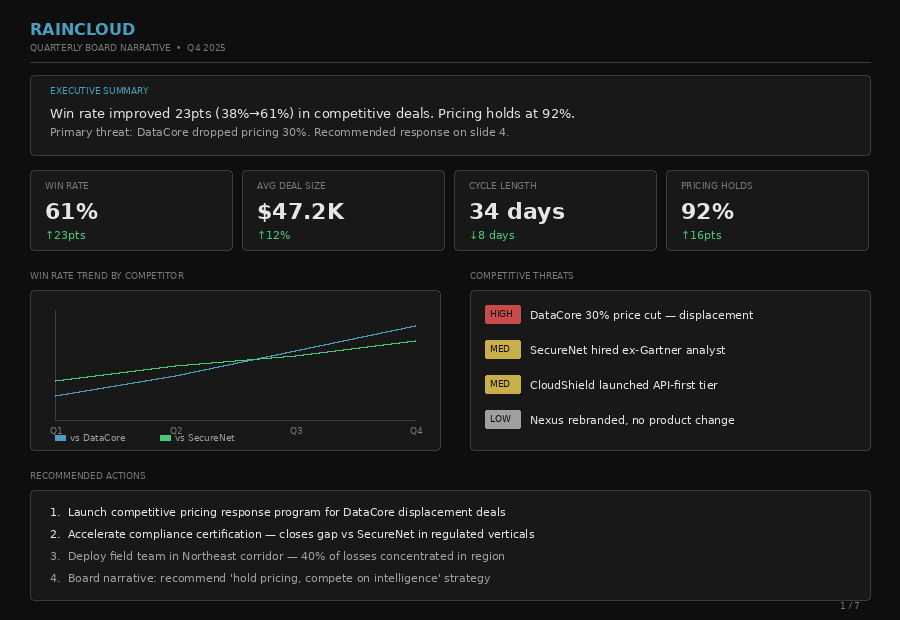

Every quarter, you receive a board-ready competitive narrative built from the analysis of 500+ sales calls, CRM data, and competitive signals. Not a dashboard. A document you drop into the board deck.

This isn't a slide someone on your team spent three days building from memory. It's a data-backed synthesis of every competitive deal your team ran this quarter — what worked, what didn't, and exactly what to do next.

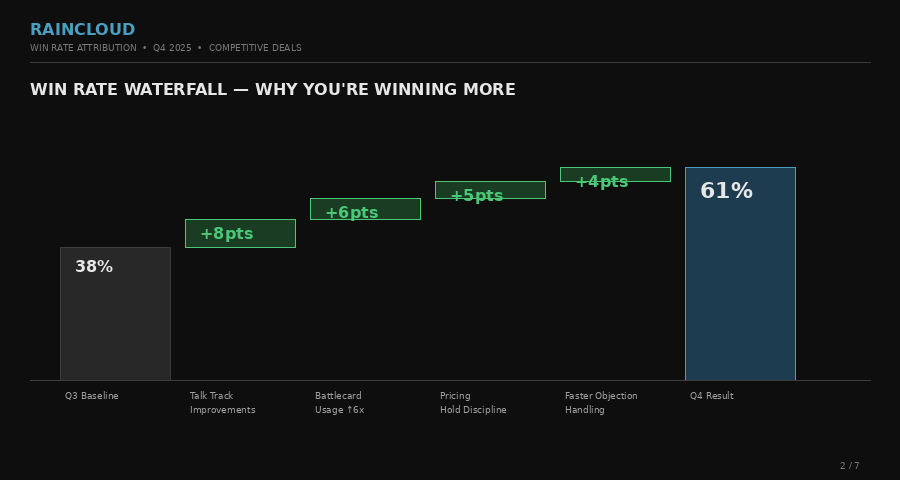

When someone asks "why did win rate improve?" you don't say "the team is executing better." You show them exactly which interventions drove which points of improvement — and which risks threaten to reverse the trend.

The board narrative is the capstone. Underneath it, your team gets a continuous stream of intelligence that compounds over time.

Updated monthly from real buyer conversations. Your reps walk into every competitive deal with current pricing, proven talk tracks, and objection handling that actually works — because it came from deals they won last month.

Every Monday, a prioritized digest of competitive moves that actually matter. Product launches, pricing changes, hiring signals, review sentiment. You'll know about threats before they hit your pipeline.

"You've built Palantir for sales analytics."

Not from more headcount or better tooling. From arming the team you already have with intelligence they didn't have before.

The Intelligence Audit surfaces patterns in week one. Battlecards deploy in week three. You'll see movement before the quarter closes.

When reps know what competitors are actually charging — not what they claim — they stop giving away margin. Confidence kills discounting.

Deals that would have been lost to stale intelligence or slow competitive response. These aren't new leads — they're revenue you were already paying to generate.

New hires onboard with current competitive intelligence from day one. No more "go shadow someone for three months and figure out the landscape."

Because the battlecards are built from conversations reps recognize. They trust them because they reflect reality, not a PMM's best guess from six months ago.

Here's what the first 90 days look like when you bring RAINCLOUD in. No disruption to your team. No new tools to adopt. No change management.

We connect to your call recording platform, pull the last two quarters of competitive deals, and cross-reference with your CRM data. We're looking for the patterns nobody has time to find — the three objections killing deals against your top competitor, the pricing threshold where you always lose, the talk track your best rep uses that nobody else knows about.

We present the findings — not in a 50-page deck, but in a focused session designed to change how you think about your competitive landscape. Most CROs tell us they found at least one pattern they'd never have discovered on their own. This is the "holy shit" moment.

Living battlecards deploy to your team. Weekly competitive radar starts landing in your inbox. The automated analysis pipeline begins processing new calls as they come in. Your reps have current intelligence for the first time.

Each new call adds to the pattern library. Battlecards update automatically. The competitive radar learns what matters to your specific market. By month three, you're walking into the board meeting with a narrative backed by the analysis of every competitive conversation your team has had all quarter.

The Intelligence Audit takes two weeks. By the end, you'll have a complete picture of what's happening in your competitive deals — and a clear plan for what to do about it. $7,500, credited against any ongoing retainer.

Book Your Intelligence Audit →