RAINCLOUD analyzes your call recordings, CRM data, and deal history over time and at scale — then delivers the competitive intelligence your revenue team needs to win more deals.

No dashboards. No new logins. Just answers.

Your tools capture everything. They synthesize nothing. The gap between data and intelligence is where deals die.

Your team listened to 20 calls last quarter. You recorded 500. The patterns in the other 480 are invisible.

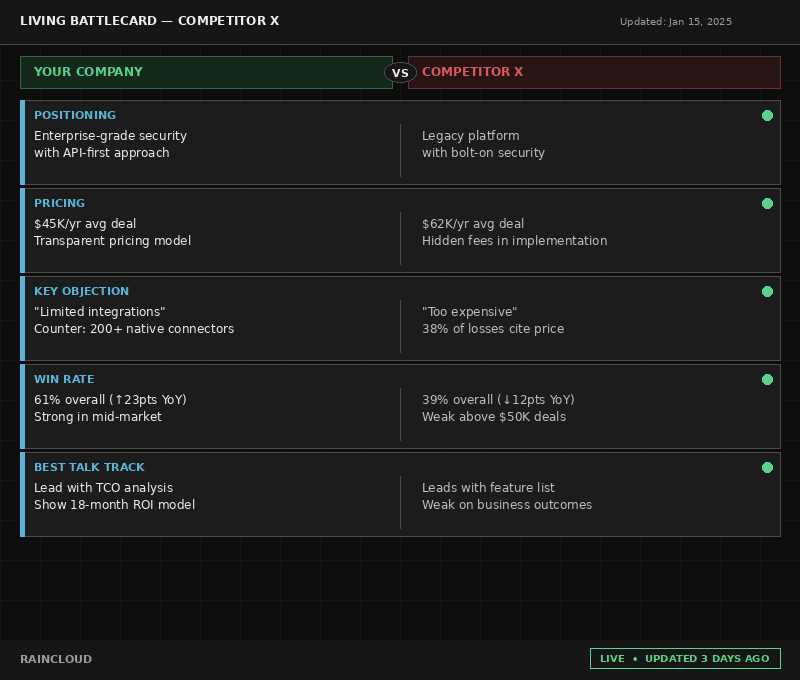

Battlecards built 18 months ago by a PMM who's since left. Pricing is wrong. Positioning is stale. Reps stopped using them.

You lost 12 deals to Competitor X. You don't know the three objections that killed them — or the talk track that could have saved them.

Dashboards show what happened. Nobody is telling you why — or what to do differently tomorrow.

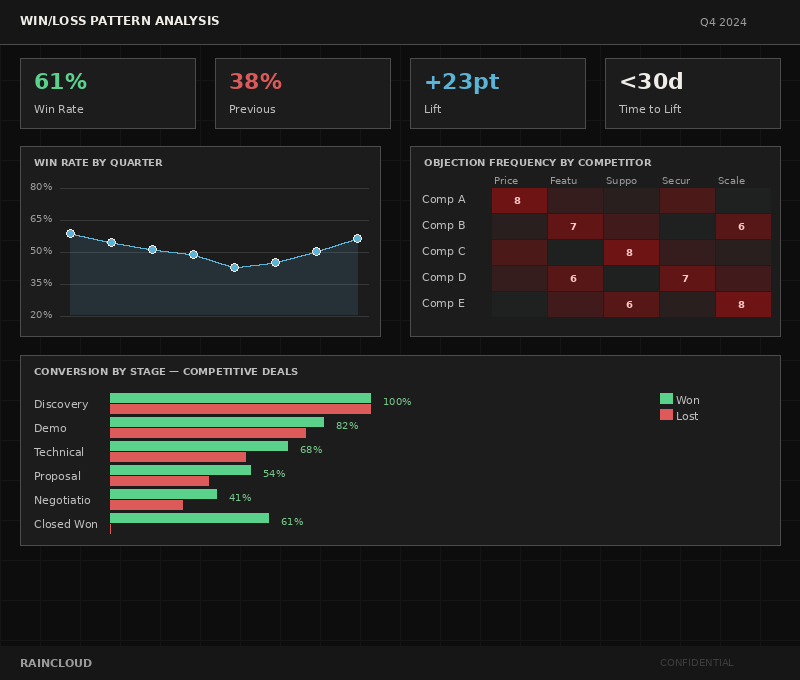

Series B ($29M ARR). Win rate plateaued at 38% in competitive deals — 12-person team losing winnable deals to stale battlecards. Full competitive intelligence deployment: 500+ call analysis, living battlecards, weekly radar.

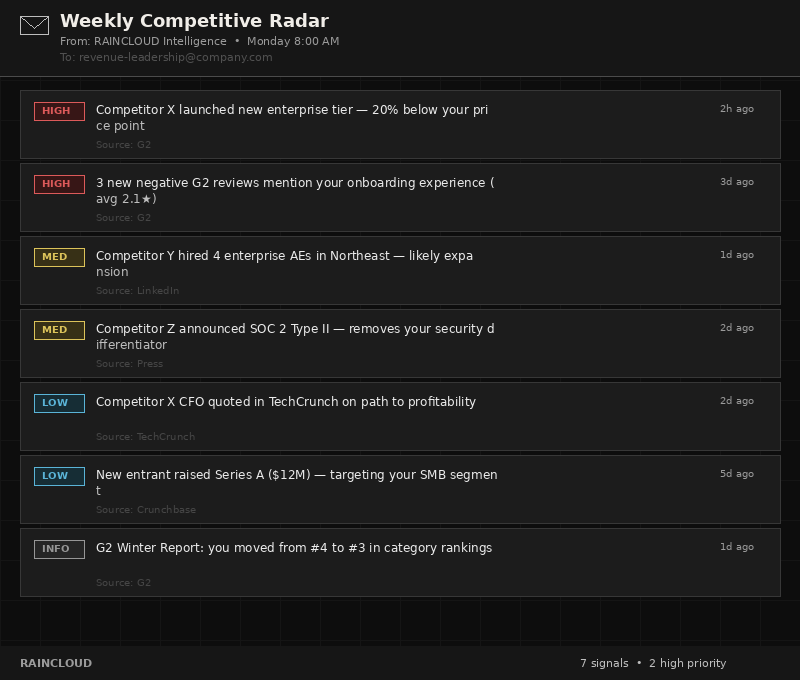

Series A ($11M ARR). Well-funded competitor dropped pricing 30% and launched displacement campaign. Sales team was reactive — learning about competitor moves mid-deal. Deployed competitive radar + living battlecards.

Wider analysis. Deeper synthesis. A human intelligence layer no platform can replicate.

500+ calls per quarter analyzed — not 10 interviews. Statistical patterns from your entire call library, not anecdotes from a cherry-picked sample.

Sales calls + CRM deal data + emails + post-mortem feedback — all correlated. What buyers told you, what reps said, what the CRM shows.

Living battlecards. Board-ready narratives. Weekly competitive radar. Delivered to your inbox — zero logins, zero dashboards.

Not consultants guessing from the outside. A practitioner who's sat in the CRO chair and knows which insights actually change pipeline outcomes.

We connect to your call recording software (Gong, Chorus, Fireflies, etc), analyze your last two quarters of competitive deals, and present a full synthesis with artifacts showing the patterns you've been missing to leadership in a 60 minute session.

We build your intelligence layer — automated call analysis, competitive monitoring, battlecard generation. Deliverables land in your inbox. Operational within 30 days.

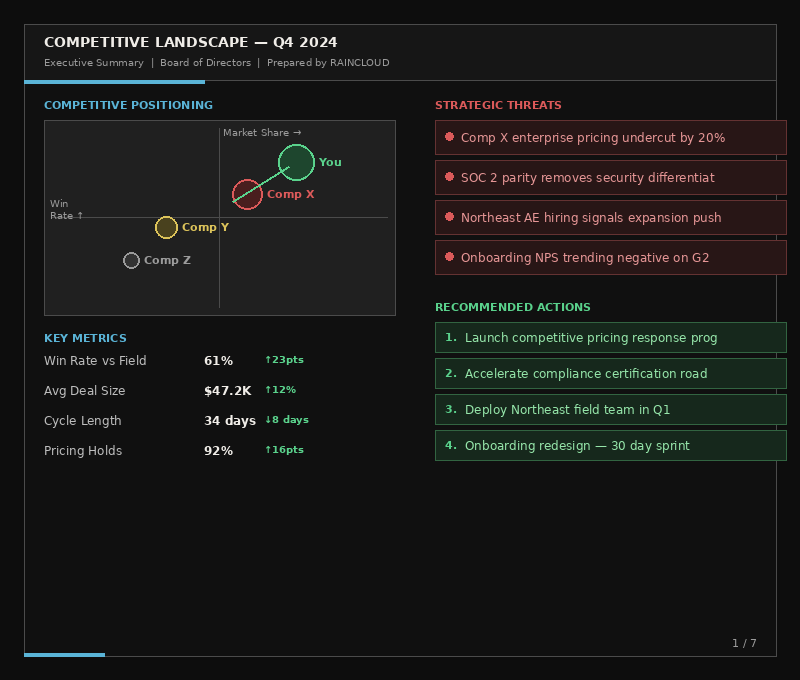

Quarterly win/loss analysis. Monthly battlecard refreshes. Weekly competitive radar. Board-ready narratives. Intelligence that compounds every quarter.

Statistical patterns from every competitive deal. Which objections kill deals? Which talk tracks win? 15–20 page report + walkthrough.

Updated from real buyer conversations. New objections, pricing intel, and counter-positioning proven to work.

Competitor moves that matter: product launches, pricing changes, hiring signals, review sentiment. Signal, not noise.

Strategic synthesis your CEO drops into the board deck. Win rate trends, competitive threats, recommended responses.

I've been in the VP of Sales seat multiple times. From VP of Sales for GoDaddy's Enterprise Sales division to VP of Channel for a PE-backed $100M cloud infrastructure firm, to serving as SVP of Revenue at a $650M AI startup, I know first-hand the battles that sales leaders face and the tools and tactics that help win the war.

That's why I built RAINCLOUD — so revenue leaders and their teams can enter competitive deals with the best possible chance to win every time.

We connect to your call recordings and CRM, analyze your last two quarters of competitive deals, and present the patterns you've been missing in a 60-minute session with your leadership team. Most CROs find at least one surprise.

Book Your Intelligence Audit